Cybersecurity Compliance: An Essential Safety Net for Your Business

Businesses are Responsible for Protecting Client Data

In today’s interconnected world, where every business relies on digital infrastructure, the threat of cyberattacks is constant and evolving. Even with robust cybersecurity measures in place, a data breach or ransomware attack can cripple operations, damage reputation, and result in significant financial losses. This is where cybersecurity insurance, also known as cyber liability insurance, becomes a vital component of any comprehensive risk management strategy.

Why is Cyber Insurance Essential?

Cyber insurance offers a crucial safety net for businesses by mitigating the financial and operational impact of cyber incidents.

- Financial Protection: Cyber insurance covers the substantial costs associated with data breaches and cyberattacks, including forensic investigations, legal fees, customer notifications, and data recovery expenses. It can also help recover lost income due to business interruption.

- Expert Support: Many cyber insurance policies include access to expert incident response teams, offering 24/7 support to help businesses manage the situation, contain the damage, and recover their systems.

- Reputation Management: Cyberattacks can damage a business’s reputation and erode customer trust. Cyber insurance policies can include reputation management services to help minimize negative impacts and restore your company’s image.

- Legal Support: Cyber incidents can lead to lawsuits and regulatory fines. Cyber insurance can provide legal support, help navigate regulatory obligations like data breach notification requirements, and cover legal defense costs.

- Business Continuity: In the event of an attack, cyber insurance can provide business continuity support, helping maintain operations during the recovery process.

What is Required to be Approved for Coverage?

Cyber insurers have become more stringent in their underwriting process due to the rising frequency and severity of cyberattacks. To qualify for coverage, businesses need to demonstrate a proactive and robust cybersecurity posture.

Here are some common requirements and steps to getting approved for cyber insurance:

- Implement Robust Security Measures: This includes strong firewalls, up-to-date antivirus and anti-malware software, encryption, and endpoint protection.

- Enforce Multi-Factor Authentication (MFA): MFA is often a minimum requirement to secure business systems and prevent unauthorized access.

- Regular Data Backups and Recovery Plans: Insurers require a reliable data backup and disaster recovery plan, including regular, automated backups, preferably with an offline or offsite copy.

- Vulnerability Management: Organizations need to implement a continuous vulnerability management program to identify and remediate weaknesses in their systems and applications.

- Employee Cybersecurity Training: Human error is a significant factor in cyberattacks. Insurers expect businesses to conduct regular cybersecurity awareness training and testing for employees to help them recognize and report potential threats like phishing attacks.

- Develop an Incident Response Plan: A written and tested incident response plan is crucial for detecting, responding to, and recovering from a cyber incident effectively.

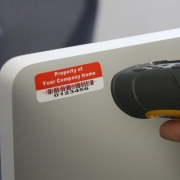

- Document Everything: Maintain thorough records of your cybersecurity policies, training sessions, patch updates, backup procedures, and incident response drills.

- Work with Cybersecurity Professionals: Consider engaging cybersecurity specialists to conduct vulnerability assessments, security audits, and penetration testing to identify and address security vulnerabilities. A qualified and experienced Managed IT Services provider like R&D Computers, Inc. can provide network vulnerability surveys and strategic support services during the development and implementation stages.

By implementing these measures and demonstrating a commitment to cybersecurity, businesses can not only reduce their risk of falling victim to cyberattacks but also increase their chances of securing comprehensive and affordable cyber insurance coverage. It’s important to remember that cyber insurance is not a substitute for robust cybersecurity, but rather a vital complement that ensures business resilience in the face of ever-evolving cyber threats.

How R&D Computers Supports Your Cybersecurity Compliance Journey

R&D Computers, Inc. offers end-to-end support to help your business meet cyber insurance requirements with confidence. Our services include:

- Management: We oversee your cybersecurity infrastructure, ensuring all systems are monitored, updated, and aligned with insurer expectations.

- Preparation: We conduct thorough assessments and readiness evaluations to identify gaps and create a roadmap for compliance.

- Training: Our team provides engaging and effective employee cybersecurity training programs tailored to your industry and risk profile.

- Implementation: From deploying MFA and backup systems to developing incident response plans, we handle the technical execution of all required cybersecurity measures.

With R&D Computers as your partner, you gain a trusted advisor who ensures your cybersecurity posture is strong, compliant, and ready for insurance approval.

Schedule a FREE Cybersecurity Compliance Consultation

We work locally, respond quickly, understand your technological needs, and ensure operational and regulatory needs for your industry are met. Call us today at 770-416-0103 or visit randdcomp.com/contact for a fast and free discovery call.